Digital Export Import Bank, Deximbank, customers are sovereign states, central banks, governments, fintech companies, and other financial institutions forming an international digital economic union governed by the Digital Currency Monetary Authority (DCMA).

Our digital economic union members share a common currency, Universal Monetary Unit (UMU), Unicoin. UMU is an international central bank digital currency (CBDC) and a money commodity regulated by the United States Commodities Futures Trading Commission (CFTC) and is configurable to comply with all money transfer regulations worldwide.

Our institutional customers offer our digital banking, trade, and payment solutions to their customers via our digital currency public monetary system.

Deximbank eliminates much of the friction in today's traditional international banking system and introduces a faster, more efficient, and less costly monetary system for facilitating trade and payments.

Universal Monetary Unit has been engineered and is governed by central banking policymakers to quality as a reserve currency to mitigate against local currency depreciation. Central banks can further regulate UMU as a complementary money commodity for adoption by merchants and trading partners.

Fintech companies worldwide can increase their market share by introducing a sustainable store of value, UMU, in their payment applications. Digital trading apps can also integrate UMU for structured escrow and milestone payments through a simple API interface.

Government policymakers can legislate UMU as a complementary money commodity for acceptance as payment by all participants in the local economy. Saving billions of dollars by reversing currency local depreciation increases income, wealth, and tax payments. Governments can transact large bilateral money transactions seamlessly without friction.

The profit margin of exporters and trading partners is highly contingent upon exchange rate fluctuations. Mitigate and reverse local currency depreciation by storing your money in UMU between payments. Ensure the integrity of your customer payments using UMU escrow and milestone payment serving.

Deximbank offers a comprehensive range of asset-backed trade financing programs. Our most favored programs are accounts receivable factoring and financing, inventory financing, standby letter of credit (SBLC) facilities, and working capital loans against qualified buyer purchase agreements.

Deximbank also supports structure payments where funds could be disbursed based on achieving milestone performance from contract signing, to inspection, proof of product, shipment, and delivery.

Deximbank offers a range of financing solutions for U.S. exporters and their customers. Limited recourse project finance and structured project financing are two programs that mitigate risk for project sponsors and help exporters compete in delivering biodiversity, climate change, and trade infrastructure projects worldwide.

Deximbank offers guarantee programs ranging from working capital guarantee and short-term trade guarantee solutions. We also offer project guarantee solutions to support project completion and bonding facilities for exports and trade contracts. We offer specific guarantee programs tailored for small and medium sized enterprises (SMEs) to stimulate and grow gross domestic product (GDP) within the local economy.

As an incentive for central banks and policymakers to legislate Universal Monetary Unit (UMU) as an official payment currency, Deximbank offers a minimum of $100M to $1B USD in investments for any jurisdiction officially adopting UMU for their local economy.

Once merchants are human capital workers accept UMU as an official payment for trade and labor payments, Deximbank can support the local economy in making large medium and long term investments in trade infrastructure and related projects.

The new world order is converging to a multi-polar monetary system in which the United States dollar, the China yuan, and the European euro are becoming the primary reserve and trade currencies. Because UMU is politically agnostic and is redeemable in the national legal tender, it strengthens, not weakens, the monetary sovereignty of any global superpower or country adopting it.

Deximbank supports the United States, Mexico, and Canada Trade Agreement and offers trade financing and guarantees of payment to buyers to stimulate further trade in this market. Deximbank is keenly supporting renewable and sustainable energy projects in North America. Deximbank is also establishing creating financing programs to support the U.S. EXIM in their business development efforts in Africa.

Deximbank aims to increase the globalization of Latin America trade by offering innovative financing programs and to finance more technology advancements and trade infrastructure in the region. The adoption of UMU can mitigate recent consumer-price gains and deliver significant financial benefit as UMU is rolled out in Latin America.

Caribbean countries face a rapidly changing environment for their exports, which presents both opportunities and challenges for economies highly dependent on external markets. Deximbank supports the redesign of the CARICOM regional trade agreement to implement the Caribbean Single Market Economy (CSME) as well as a number of preferential trade agreements within the region.

The world views Africa as the biggest untapped market for foreign direct investment and international trade. Deximbank supports the Africa Continental Free Trade Agreement (AfCFTA). UMU can reverse local currency depreciation and serve as a common and complementary currency for both continental and international trade.

Deximbank is positioned to assist the Middle East in its strategy to diversify from oil producing revenues to other long-term investments in machinery, vehicles, aircraft, precious stones, and electrical machinery and to expand trade within the region to offset the anticipated slower growth from global markets.

The world views Africa as the biggest untapped market for foreign direct investment and international trade. Deximbank supports the Africa Continental Free Trade Agreement (AfCFTA). UMU can reverse local currency depreciation and serve as a common and complementary currency for both continental and international trade.

The European Union has recently adopted a new global trading strategy called "Open Strategic Autonomy" in its efforts to become more independent from other superpowers. Deximbank also agrees with the EU that biodiversity and climate change investments can coexist. We are seeking to support more sustainable energy projects in the region.

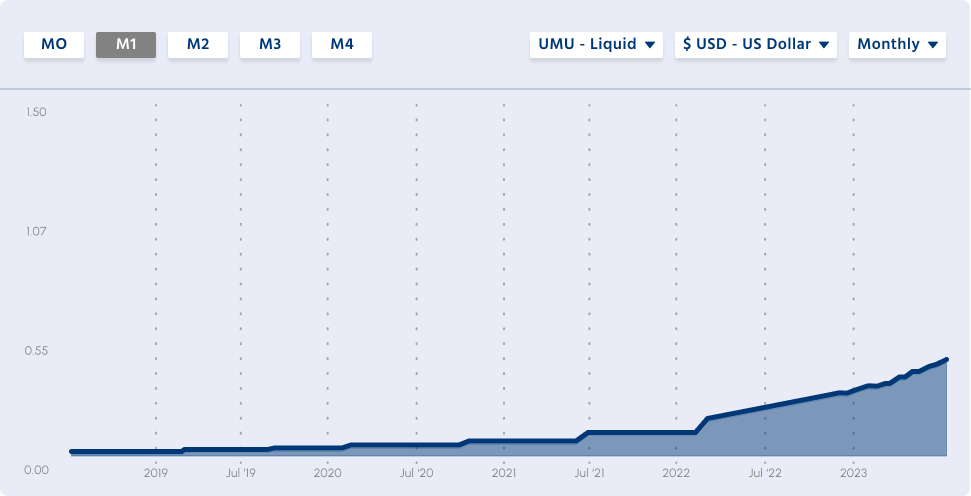

Universal Monetary Unit (UMU), Unicoin, is an innovation of a store of value money commodity which has historically performed stronger than any national legal tender.

UMU is not a legal tender and purchase agreements are not negotiated in UMU. UMU simply serves as a common payment currency within our digital economic union and pays the equivalent value of the negotiated settlement currency. For example, Nigeria and Ghana could negotiate a trade to be settled in the Euro but paid in the UMU equivalent value.

UMU as a common payment currency is possible because it maintains the wholesale foreign exchange rates to all national legal tenders within each wallet.

UMU also strengthens the monetary sovereignty of local economies because UMU must be purchased and liquidated in the local currency ensuring no capital outflows to another foreign currency.